| Amicus | |

| System wide settings | |

| Submit feedback on this topic | |

| Preferences > Costing Module > System wide settings |

Glossary Item Box

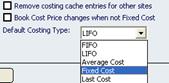

When the Costing Setup Module has been enabled the following options are added to the Preferences for All Tills > System tab as shown in Figure. Further information on the System tab is available in System.

Figure : Costing options added to the Preferences All Tills System tab

Remove costing cache entries for other sites: Check to remove all stocktake information that does not affect the current site.

Book cost price changes when not Fixed Cost: Check to change the book cost field from a read only field to an active field.

Default Costing Type: Select the system wide accounting method from the drop-down list. NBS Amicus enables costing to be calculated using the following multiple complex accounting methods:

-

FIFO(First In, First Out) method — assumes the first stock purchased will be the first stock sold. The current stock on hand is based on the costs from the stock receipt records that were entered first. The ending inventory is assumed to consist of the cost of the most recently purchased stock.

-

LIFO(Last In, Last Out) method — assumes the most recent stock purchased will be the first stock sold. The current stock on hand is based on the costs from the stock receipt records that were entered last. The ending inventory is assumed to consist of the cost of the earliest purchased stock. Important Note: Legislative requirements prevent Australian companies from preparing tax statements and financial reports using LIFO.

-

Average Cost method — uses the average cost of the stock. It is calculated by dividing the total cost of stock available for sale by the total number of stock units available for sale. The current stock on hand is based on the average cost from the records.

-

Fixed Cost method — uses the same cost when volume changes occur. The total amount will remain relatively constant.

-

Last Cost method — is simply the cost this item was the last time it was received in a stock receipt.