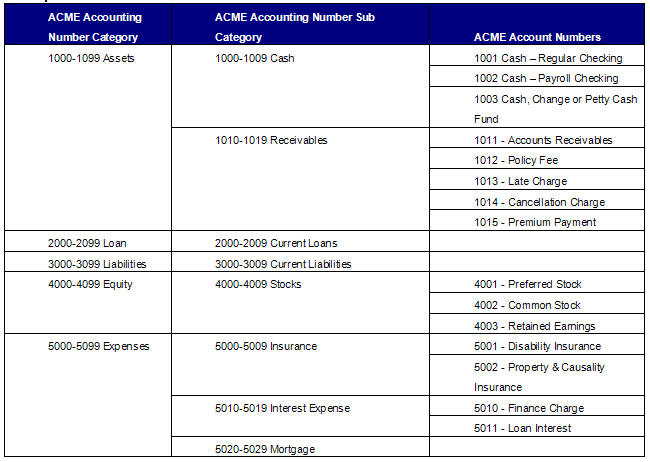

Chart of Accounts Overview

Chart of Accounts (CoA) is used to record transactions in a company’s general ledger. As part of the accounting cycle, the CoA is used in the journaling process (i.e., performing journal entries) and also serves as the title for each ledger. In general, all accounts are filed under one of five categories: assets, liabilities, owner's equity, revenue and expenses.

Each company may use its own CoA numbering system and may assign a number for identification purposes. A block of numbers may be assigned to one of those five categories and then be further divided into sub-categories. Gaps may be left between sub-category listings to allow for the addition of new accounts.

Sample of Chart of Accounts

Common practice is to use cycle to generate accounting from executed transactions, gather that data into a format ready for an interface, send the data to middleware, and generate a configurable report for delivery to interested parties. There is no direct communication to a general ledger system.

Chart of Accounts in OIPA

CoA is set-up at the company level in OIPA. When a financial transaction or suspense is processed and a CoA record(s) is present, an accounting record is generated that associates an account number with each piece of money as defined. The accounting records are generated when an activity is processed/reversed or when the suspense record is added/deleted.

Accounting records are stored in the AsAccountingDetail and AsAccountingDetailField tables. The AsAccountingDetail table stores the information for debit and credit amounts, which result from an activity or suspense add/deletion. It also stores information for account number, processing, reversing, gain/loss, dates and any information needed to initiate activity/suspense. If configured, additional information may be captured according to the client requirements in the AsAccountingDetailField table.

General Accounting

CoA entries that are based on math variables or non-fund specific allocations (general accounting) will use values in the transaction math and will write these values to the database when two conditions are met:

- GenerateAccounting is set to True.

- The activity processes successfully without any non-overridden business errors.

Separate Accounting

CoA entries that are based on funds (separate accounting) will wait until all AsValuation records for the activity are moved into an active state and there are no non-overridden business rule errors generated from the PostAssignmentValidateExpressions rule.

If there are no PostAssignmentValidateExpressions validation errors and all of the valuation records are in an active state for either type of accounting, even if the activity is still in an NUV Pending status, the Accounting records for each fund can be written. For each execution of the activity, the accounting will run again but will check to see if a fund accounting record already exists for the activity. Even though the valuation records may be active before the activity moves into an active state, the accounting will not be written if there are validation errors in PostAssignmentValidateExpressions.

Account to Transaction Relationship

An account may be associated with one or more financial transactions and/or suspense actions. This is a one-to-many relationship: account to transactions.

Example:

Account 1001 is associated to receive premium via money types from two different transactions:

-

InitialPremium transaction

-

AdditionalPayment transaction

Transaction to Account Relationship

In CoA, an account is higher than a transaction in the hierarchy because a transaction is associated to accounts. It may be helpful from a configuration context to understand that a transaction can have one or more accounts associated with it depending on money types, plan, math variable, status of account, transaction effective date, reversal indicator, gain/loss indicator and user-defined criteria. This is a one-to-many relationship: transaction to accounts.

Example:

A disbursement transaction may have two different accounts associated with it:

-

Account 9001 for a Variable Annuity plan

-

Account 9002 for a Variable Payout plan

Transactions are associated with accounts at the entry level, which is set-up during step three of the CoA wizard.

Account and Account Entry Details

An account may have one or more sets of entry details. Criteria may be configured as a filter for the correct accounting output. Additional account details may also be configured for the specific accounting output.

Example:

Account 9001 -> AccountEntryDetail record 1: Original Disbursement Status- Pending

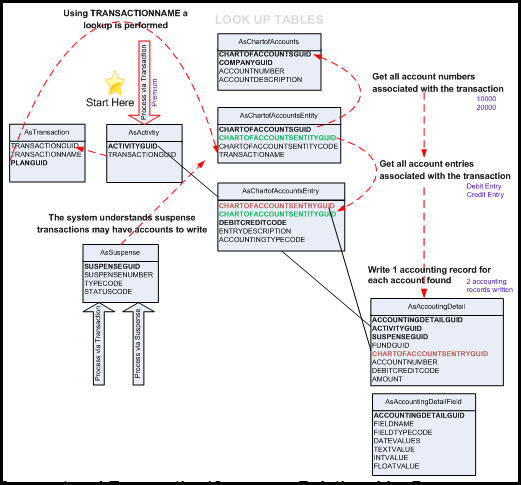

Visual Diagram of CoA Flow

Below is a visual diagram of the CoA flow. Start at the star and follow the red doted lines to see the order the system follows. The black solid lines denote important relationships between tables that create CoA records.

Diagram of CoA Flow

Copyright © 2009, 2014, Oracle and/or its affiliates. All rights reserved. Legal Notices