Fixed Interest Rate Calculation

When performing valuation, OIPA must be able to accurately calculate and then credit interest to a fixed fund. There are many factors that come into play, including various calculation methods, fixed, variable or additive rates and multiple definitions of what constitutes a year.

Scenario

Multiple scenarios were constructed to demonstrate this functionality. Each of the ten funds created for the Prototype Company were created to demonstrate a particular aspect of the functionality. The types of situations that the funds were configured to represent are listed below. Refer to the fund descriptions below to see which fund demonstrates which aspect of fixed interest rate calculation.

-

Recognize leap year

-

simple interest

-

guaranteed rates

-

additive rates

-

varying definitions of a year

Configuration Requirements

The following configuration requirements are necessary to implement fixed interest rate calculation.

-

funds must be configured with InterestRateCalculation fund level overrides for each fund.

-

rates used by the funds should be uploaded through the Admin Explorer, using the Rate Groups editor or SQL statements.

-

A table must exist to hold additive rate codes if needed: AsCodeAdditiveRate.

-

Components to execute valuation like transactions, ValuesScreen and InquiryScreen.

Prototype Samples

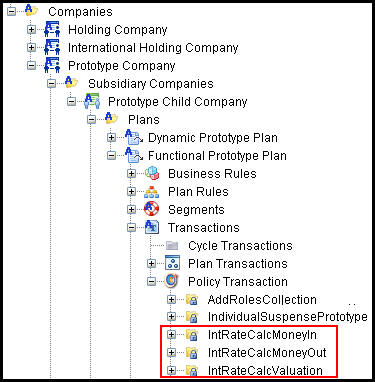

There are three transactions configured to demonstrate fixed interest rate calculation. Navigate through the following folders in the Main Explorer to locate the configuration sample: Companies | Prototype Company | Subsidiary Companies | Prototype Child Company | Plans | Functional Prototype Plan | Transactions | Policy Transactions.

-

IntRateCalcMoneyIn: Demonstrates the ability to invest in one or multiple funds with the calculation of interest performed independently of each other.

-

IntRateCalcValuation: Calculates interest to the point in time that is selected.

-

IntRateCalcMoneyOut: Calculates simple interest. Principle and interest are tracked separately. When money is taken out, the interest is taken first followed by the principle. This activity demonstrates how the principle and interest columns are affected.

Fixed Interest Rate Calculation Transactions in Main Explorer

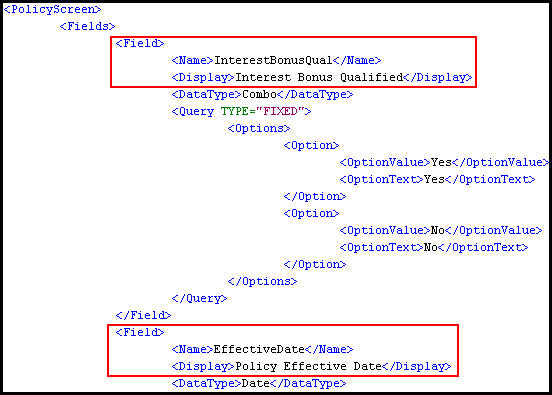

There are two fields added to the PolicyScreen. This can be seen in the PolicyScreen plan level override. Navigate in the Main Explorer to Companies | Prototype Company | Subsidiary Companies | Prototype Child Company | Plans | Functional Prototype Plan | Plan Rules | PolicyScreen (Functional Prototype Plan).

-

InterestBonusQual

-

EffectiveDate

PolicyScreen Business Rule with New Interest Fields

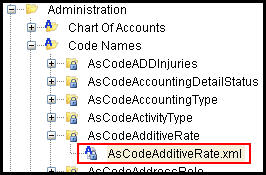

There is one new AsCode table. The values in this table can be edited through the Code Names folder in Admin Explorer. Navigate to Admin Explorer and open Administration | Code Names | AsCodeAdditiveRate.

-

AsCodeAdditiveRate

AsCodeAdditiveRate Editor in Admin Explorer

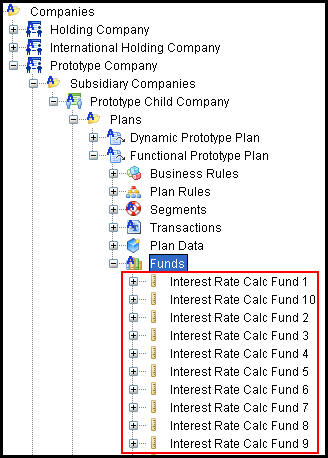

There are ten funds and each demonstrates specific calculations. The details of each fund's configuration are explained below. They are located in the Funds folder. Navigate to the Main Explorer and open Companies | Prototype Company | Subsidiary Companies | Prototype Child Company | Plans | Functional Prototype Plan | Funds.

-

Interest Rate Calc Fund 1

-

Static decimal rate

-

Current interest with one additive interest that sometimes adds to the current interest rate. The additive interest is turned on or off based on whether the InterestBonusQual PolicyScreen field is set to Yes. If set to No, the additive rate = 0.

-

Compound interest

-

Policy year (365)

-

Interest period end

-

Helped to determine when the rate changed; end of day or beginning of day.

-

Adjust date calculation: no

-

Fund level tracking

-

Interest Rate Calc Fund 2

-

Lookup a percentage rate

-

Immediate change upon declaration of new rate

-

Current interest only

-

Compound interest

-

Calendar year (365)

-

Interest period begins at the beginning of the day

-

Adjust date calculation: no

-

Fund level tracking

-

Interest Rate Calc Fund 3

-

Lookup a decimal rate

-

Changes on anniversary of deposit

-

Last known rate; the rate will not change until anniversary

-

Current interest only

-

Compound interest

-

360 day year

-

Interest period begin

-

Adjust date calculation: no

-

Deposit level tracking

-

Interest Rate Calc Fund 4

-

Look up a decimal rate

-

Changes on anniversary of deposit

-

Age of deposit (For example, on the day of deposit, the deposit date age = 0)

-

Current interest only

-

Compound interest

-

Policy year

-

Interest period begin

-

Adjust date calculation: no

-

Deposit level tracking

-

Interest Rate Calc Fund 5

-

Look up a decimal rate

-

Changes on anniversary of policy

-

Age of policy

-

Current interest

-

Compound interest

-

365 day year with leap day

-

Interest period begin

-

Adjust date calculation: no

-

Guaranteed interest rate

-

Static rate: compares current rate against guaranteed rate to determine which rate is greater

-

Fund level tracking

-

Interest Rate Calc Fund 6

-

Look up a percentage rate

-

Changes on the anniversary of the policy, biennially guaranteed for two years

-

Age of policy

-

Current interest

-

Compound interest

-

365 day year with no leap day

-

Interest period begin

-

Adjust date calculation: no

-

Guaranteed interest rate

-

Lookup rate

-

Fund level tracking

-

Interest Rate Calc Fund 7

-

Look up a decimal rate

-

Changes on anniversary of policy

-

Current interest

-

Simple interest

-

Policy year

-

Interest period begin

-

Adjust date calculation: no

-

Guaranteed interest rate

-

Static

-

Fund level tracking

-

Interest Rate Calc Fund 8

-

Lookup a decimal rate

-

Immediate change

-

Current interest only

-

Compound interest

-

Calendar year

-

Interest period end

-

Adjust date calculation: no

-

Fund level tracking

-

Interest Rate Calc Fund 9

-

Lookup a decimal rate

-

Immediate change

-

Current interest only

-

Compound interest

-

Calendar year

-

Interest period begin

-

Adjust date calculation, yes

-

Fund level tracking

-

Interest Rate Calc Fund 10

-

Lookup decimal rate

-

Never changes

-

Current interest only

-

Compound interest

-

Policy year

-

Interest period begin

-

Adjust date calculation, no

-

Fund level tracking

Interest Rate Funds in Main Explorer

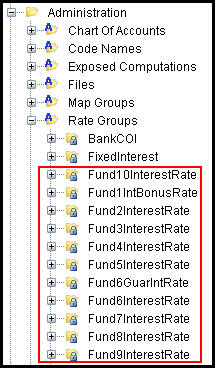

Rates were added for each fund and can be found in the Admin Explorer in the Rate Groups folder. The Rate Descriptions are as follows:

-

Fund 1: Fund1IntBonusRate or ZeroRate

-

Fund 2: Fund2InterestRate

-

Fund 3: Fund3InterestRate

-

Fund 4: Fund4InterestRate

-

Fund 5: Fund5InterestRate

-

Fund 6: Fund6InterestRate and Fund6GuarIntRate

-

Fund 7: Fund7InterestRate

-

Fund 8: Fund8InterestRate

-

Fund 9: Fund9InterestRate

-

Fund 10: Fund10InterestRate

Rates for Funds in Prototype Company

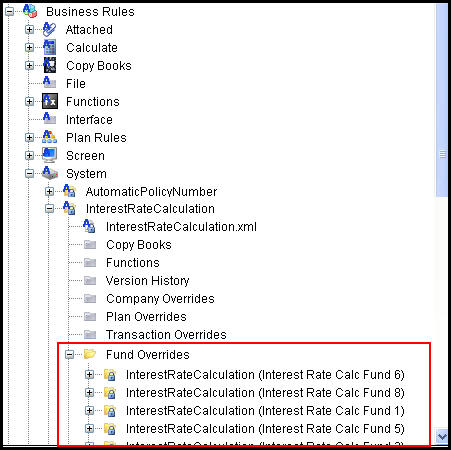

There is one new business rule created to expose the components that describe the attributes of the interest calculation of fixed funds. This new rule will support deposit and fund valuations. This system rule exists globally, void of any configuration, with Fund Overrides for each of the ten funds. Navigate in the Global Rules Explorer to Business Rules | System | InterestRateCalculation | Fund Overrides.

-

InterestRateCalculation

InterestRateCalcuation Fund Level Overrides in Global Explorer

Copyright © 2009, 2014, Oracle and/or its affiliates. All rights reserved. Legal Notices