Understanding OIPA Valuation Mechanisms

Before configuring a plan that will value policies it is important to understand how OIPA processes values. The OIPA code will perform hard coded calculations depending on the type of funds being used for valuation. OIPA will also perform certain predefined steps when valuation is run. This is known as running the valuation engine.

A transaction may be configured to execute or not execute the valuation engine. Upon execution of the valuation engine, the OIPA system gathers the fund information needed to perform the valuation steps. The information gathered is dependent on the use of Point-In-Time valuation or Traditional valuation.

- Point-In-Time valuation: uses the fund and/or deposit information and values as of the last time valuation was executed by an activity on the policy. When an activity executes Point-in-Time valuation for a fixed fund, the rounded cash value is stored in the CashValue column on AsFundValue and AsDepositValue. Additionally, the unrounded cash value is stored in the RawCashValue columns on these tables as well. When valuation is subsequently executed for the fixed funds, the RawCashValue data is used as the beginning value for the fund.

- Traditional valuation: uses all of the policy’s deposits and removals since inception of the policy. Traditional valuation gathers this information by calculating the policy’s fund values as of each deposit and removal date until it reaches the last. The data accumulated to this point is kept in OIPA system memory and is known as the Valuation Structure.

With both methods now at a similar point, fund and deposit values are calculated to the current valuation date. Results of the calculations are stored in the Valuation Structure. Data in the Valuation Structure are available to the Math section. Each fund type follows a different calculation path in the OIPA system to achieve the policy’s/fund’s/deposit’s values.

Refer to the XML Configuration Guide topic in this help system for information on using Valuation prefixes to access values within the valuation structure. Select Common Elements | Available Prefixes and Fields for Configuration.

Configuring Valuation

Valuation can be configured and run at the transaction level. The output can be viewed on the OIPA Activity Results screen. Valuation can also be configured at the policy level. The output can be viewed on the OIPA Values screen.

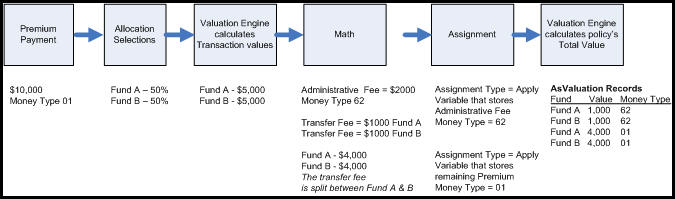

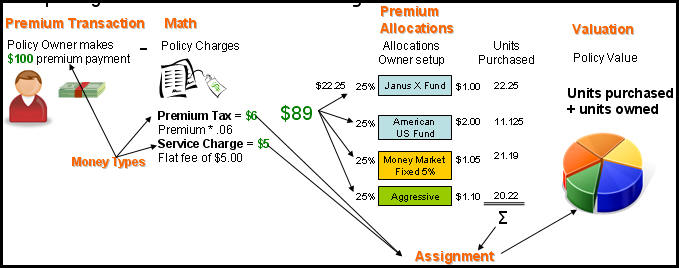

High Level Valuation Steps

High Level Work Flow Diagram

Valuation Structure

In traditional valuation, when the system calls the valuation engine, the engine creates a valuation structure. The valuation structure includes the policy, fund, deposit and removal information since the inception of the policy. The Valuation Structure is then stored in XML when the activity is completed. View sample valuation structure.

Active Valuation

Initially all valuation records are in a pending state but as more values are known the status moves to an active state. This update is system driven and not configurable, much like normal disbursement and activity status transitions.

As the assignment is written, redemption records receive negative amounts and units while subscriptions are positive.

For unit linked funds, an attached activity could be in NUV Pending status and its valuation records would need to be excluded from the valuation process. This means that a unit linked valuation record is only active if:

- It has an effective date less than or equal to the valuation date input.

- The current system date falls between its active dates.

- When all the Redemption amounts and units for an activity are known and written, the Subscription amounts can also be derived and written at the same time so all Valuation records can also move to an active state. Otherwise the status is unchanged. The activity will remain in an NUV Pending state until the Redemption units are known.

When all three of the above criteria are met, the record is written to AsActiveValuationActivity and will be included when valuing the policy.

Valuation XML

The Valuation XML is made up of specified values that can be used in a transaction's math section. Most of the valuation structure cannot be changed and is hard coded. The valuation structure and its content cannot be changed during the execution of the activity that created it. There is one business rule called PolicyValues, which allows custom configuration of values and is added to the valuation structure. The structure with its associated values are located in the XMLData column of the AsValuationXML table.

Use these values in a transaction's math by prefixing a MathVariable with Valuation: and the node path separated by colons. This is discussed in more detail in the Configuring Math section.

With Point-In-Time valuation, a valuation structure is also created. This structure consists of the last known policy/fund/deposit values. Its values are available in a transaction’s math section using the same syntax as above. The structure is not saved in the AsValuationXML table.

Example of XML Valuation Structure taken from AsValuationXML

Copyright © 2009, 2014, Oracle and/or its affiliates. All rights reserved. Legal Notices