InterestRateCalculation Rule

The InterestRateCalculation rule supports fixed interest calculation. It supports guaranteed and current interest calculations as well as any number of additive interest rates such as bonus interest rates. The interest calculation may be compounded or simple and there are methods for different interpretations of the year (360, 365, 365 plus leap year determination).

In its simplest implementation, the InterestRateCalculation rule can

be used to set static fixed rates for a fixed fund. More complex configurations,

such as retrieving interest rates from a rate table can also be configured.

Please refer to the XML

Configuration Guide under

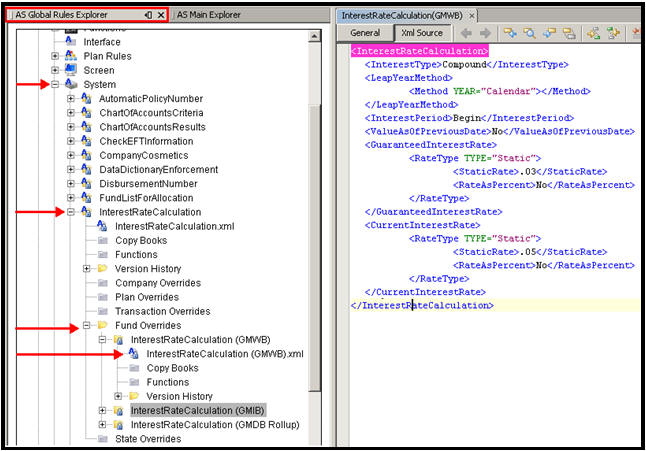

Steps to Configure the InterestRateCalculation Business Rule

-

Navigate to the Global Rules Explorer.

-

Expand the Business Rule folder.

-

Expand the System folder.

-

Right-click on InterestRateCalculation.

-

Select New InterestRateCalculation override. The Override Wizard opens.

-

In step 1, select Next.

-

In step 2, select the company, plan and fund where this override will be used.

-

Select Finish.

Configure the interest calculation logic in the Xml Source Pane of the override of the InterestRateCalculation that was created. Refer to InterestRateCalculation in the V9 XML Configuration Guide under Tools | Help for a complete explanation of XML elements and attributes.

InterestRateCalculation rule in Global Rules Explorer

Example of InterestRateCalculation business rule for a fixed fund:

<InterestRateCalculation>

<InterestType>Compound</InterestType>

<LeapYearMethod>

<Method YEAR="Calendar"></Method>

</LeapYearMethod>

<InterestPeriod>Begin</InterestPeriod>

<ValueAsOfPreviousDate>No</ValueAsOfPreviousDate>

<GuaranteedInterestRate>

<RateType TYPE="Static">

<StaticRate>.03</StaticRate>

<RateAsPercent>No</RateAsPercent>

</RateType>

</GuaranteedInterestRate>

<CurrentInterestRate>

<RateType TYPE="Static">

<StaticRate>.05</StaticRate>

<RateAsPercent>No</RateAsPercent>

</RateType>

</CurrentInterestRate>

</InterestRateCalculation>

Copyright © 2009, 2014, Oracle and/or its affiliates. All rights reserved. Legal Notices