Allocations and Assignments

Allocations, Assignments and Valuation work together to move money between funds associated with a policy and track the value of the funds. Assignment allows money to be deposited, withdrawn or transferred from the funds. Allocation provides a request as to how to affect each fund, such as a deposit, withdrawal or transfer. Valuation is the result after money movements are completed.

Allocations

Allocations support the movement of money into or out of funds. When payments or withdrawals are made, the configuration of allocations allows for the introduction of logic to move the money into or out of a fund.

Plan-level Allocations are allocations made at the plan level. For example, during the Freelook period all deposits are invested in Fund A until the end of the Freelook period is reached where it will be distributed to the funds specified by the client. The allocation to Fund A during the Freelook period is an example of a plan allocation. The plan-level allocations are specific to a plan, not a client or policy. Plan-level allocations can be established using the AllocationScreen business rule.

If Allocation data needs to be displayed, the AllocationScreen business rule must be configured.

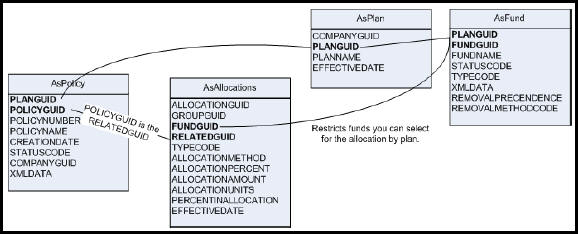

Allocation data is stored in the AsAllocation database table. The AsAllocations table is linked to the AsPolicy, AsPlan and AsActivity tables through the RelatedGUID column.

Allocation Table and Related Tables

Assignments

Assignments are used in conjunction with allocations when the allocated values are to be applied, transferred, or removed from a policy's value. Assignment values can be in the form of a monetary amount, percentages, number of units or pro-rata distribution of the allocation. There are several types of assignments that can be used, namely:

-

APPLYBYFUNDTO: used to apply money/units to a fund for a specific policy.

-

GROSSWITHDRAW: used to remove money/units from a fund for a specific policy.

-

TRANSFER: used to move money/units from one a fund to another fund for a specific policy.

- SWITCH: used specifically for unit linked products. This is similiar to the TRANSFER assignment, in that it moves money/units from one fund to another on a policy.

- WITHDRAWAL: supports the removal of amounts or percents from unit linked funds.

Additional assignment types can be found in the XML Configuration Guide.

Completion of Assignment processing always adds new records to AsValuation; the record of the money movement. The Assignment process will update existing allocation records on AsAllocation when it is executing a pro-rata distribution of the money movement. In all situations, if the business rule ReassignAllocations is attached to the activity, Assignment processing will add new records to AsAllocation based on the allocation results from ReassignAllocations.

Assignment Processing for Child and Lateral Funds

When Assignment looks up the necessary sub-funds (child and lateral) for valuation purposes, the criteria under the Child funds will only apply the funds with an AsFundRelation type of 01 and the criteria under the Lateral funds will only apply the funds with an AsFundRelation type of 03. The Assignment will further filter the lateral funds by the activity effective date relative to the lateral fund relationship effective and expiration dates. Both fund relation dates are inclusive so that the relation is effective through the expiration date, not to it.

Assignments for child funds will use the fund that matches the fund relation criteria specified in the child fund level.

Deposit Assignments for lateral funds will use the fund that matches the fund relation criteria specified in the lateral fund level and whose effective date is less than or equal to the activity effective date and whose expiration date is null or greater than or equal to the activity effective date. If the EffectiveDateNUVMustExist element is set to Yes then all lateral funds for the parent matching the criteria (regardless of effective and expiration dates) must have prices for the activity effective date.

If NUVs are not found, then a business error is displayed saying, “NUVs for Effective Date Missing.”

The SystemDateNUVMustExist element will be ignored regardless if set to Yes, as no gain or loss will be calculated.

Removal Assignments will remove amounts allocated to type 04 parent funds from the individual lateral fund deposit amounts based on the parent fund’s removal method (LIFO or FIFO) and removal precedence. The larger the removal precedence value, the later the fund will be used in money removal. Deposits of funds with a removal precedence of 1 will be exhausted before deposits on the same date for funds with a higher removal precedence value. This feature will work for all fund types.

Activity Valuation for Child and Lateral Funds

Activity valuation will calculate individual lateral fund deposit values and write the records using the parent fund GUID. The FundGUID of the lateral fund will be captured on the valuation tables in order for the system to map back to the correct fund prices during subsequent valuations. (AsValuation, AsDepositValue). The EffectiveDate of the valuation record will be stored on the valuation table in order for the system to map back to the correct fund prices during subsequent valuations. (AsDepositValue). Only the parent fund name will display in the UI with an aggregated sum of all the lateral fund deposit valuations. Unit values will not display for the funds.

Copyright © 2009, 2014, Oracle and/or its affiliates. All rights reserved. Legal Notices