Home > Report Designer > Excel Workbook > BI Tools Tab > Mapping Tool > Accessing and Using the Mapping Tool

Mapping Tool

Accessing the Mapping Tool

In the event that the Reporting Group that a category has been mapped to, needs to be changed, use the Mapping Tool Icon on the Microsoft Excel BI Tools ribbon to access the Mapping Tool.

Using the Mapping Tool

In most instances when you are running a standard report from the Report Designer your Categories will automatically be mapped to Reporting Groups.

If you have added any new Categories, these will appear as Unmapped Categories when the report is run again, and you will need to map these to Reporting Groups.

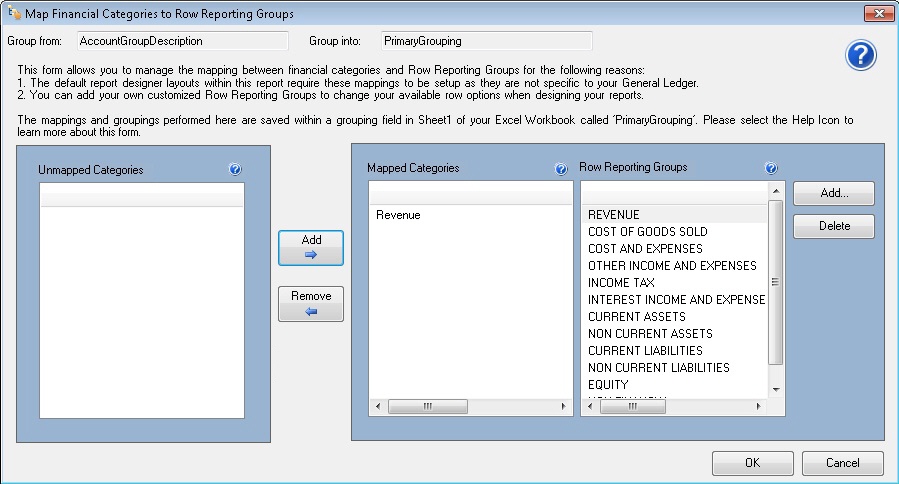

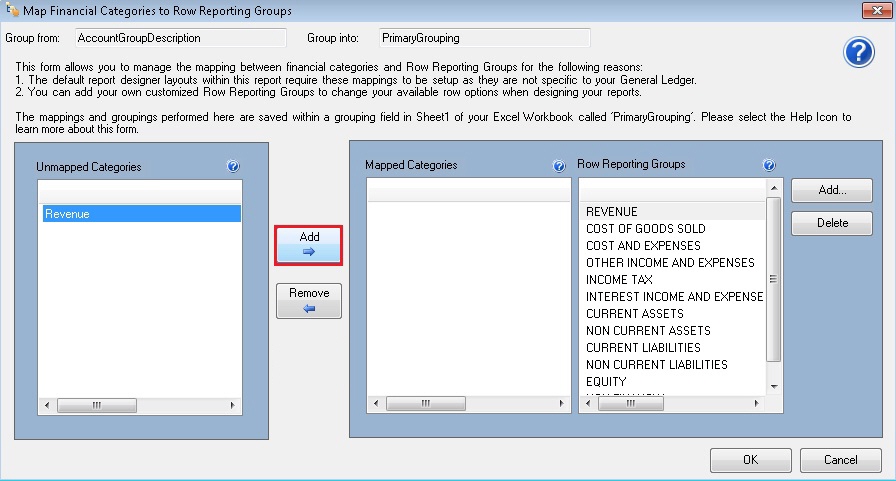

To understand the Mapping Tool window please be aware of the following definitions:

Categories : These are extracted as you have created them in your source system.

UnMapped Categories : These are Categories from your source system that must be mapped to designated Reporting Groups in order to be used in report layouts.

Mapped Categories : These are Categories that have been mapped to designated Reporting Groups and can be used in report layouts.

Row Reporting Groups : These Reporting Groups can be used to generate multiple report layouts.

If your accounts need to be mapped please use the following process:

- Select the Row Reporting Groups on the right.

- On the left, in the Unmapped Categories section, select the category to map to the Reporting Category selected in step1. Multiple categories may be selected by holding down the CTRL key and clicking on the category.

- Click Add.

- Once completed, click OK.

- You should create and link the workbook as a template file back to the Report Designer report in the Report Manager. This will ensure that your mappings are saved for the next time you run out the report.

- Run Report Designer again and generate new layouts with the new Mapping now in place.

Mapping Tool Glossary

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business (called retained earnings), or it can be paid to the shareholders as a dividend. Many corporations retain a portion of their earnings and pay the remainder as a dividend

Long term borrowing, in economics, is the period of time required for economic agents to reallocate resources, and generally re-establish equilibrium. The actual length of this period, usually numbered in years or decades, varies widely depending on circumstantial context. During the long term, all factors are variable.

A sale is the pinnacle activity involved in selling products or services in return for money or other compensation. It is an act of completion of a commercial activity

Cost of Sales includes the direct costs attributable to the production of the goods sold by a company. This amount includes the materials cost used in creating the goods along with the direct labor costs used to produce the good. It excludes indirect expenses such as distribution costs and sales force costs. COS appears on the income statement and can be deducted from revenue to calculate a company's gross margin.

Expense has a very specific meaning. It is an outflow of cash or other valuable assets from a person or company to another person or company. This outflow of cash is generally one side of a trade for products or services that have equal or better current or future value to the buyer than to the seller.

To tax is to impose a financial charge or other levy upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state such that failure to pay is punishable by law.

Fixed asset, also known as property, plant, and equipment (PP&E), is a term used in accounting for assets and property which cannot easily be converted into cash. This can be compared with current assets such as cash or bank accounts, which are described as liquid assets. In most cases, only tangible assets are referred to as fixed.

Current asset is an asset on the balance sheet which is expected to be sold or otherwise used up in the near future, usually within one year, or one business cycle - whichever is longer. Typical current assets include cash, cash equivalents, accounts receivable, inventory, the portion of prepaid accounts which will be used within a year, and short-term investments. On the balance sheet, assets will typically be classified into current assets and long-term assets.

Accounts receivable (A/R) is one of a series of accounting transactions dealing with the billing of customers who owe money to a person, company or organization for goods and services that have been provided to the customer. In most business entities this is typically done by generating an invoice and mailing or electronically delivering it to the customer, who in turn must pay it within an established time frame called credit or payment terms.

Inventory is a list for goods and materials, or those goods and materials themselves, held available in stock by a business.

Investment is the active redirection of resources/assets to creating benefits in the future; the use of resources/assets to earn income or profit in the future. It is related to saving or deferring consumption.

Share capital or issued capital (UK English) or capital stock (US English) refers to the portion of a company's equity that has been obtained (or will be obtained) by trading stock to a shareholder for cash or an equivalent item of capital value. For example, a company can set aside share capital to exchange for computer servers instead of directly purchasing the servers from existing equity.

Retained earnings refer to the portion of net income which is retained by the corporation rather than distributed to its owners as dividends. Similarly, if the corporation makes a loss, then that loss is retained and called variously retained losses, accumulated losses or accumulated deficit. Retained earnings and losses are cumulative from year to year with losses offsetting earnings.

Shareholder loan is a debt-like form of financing provided by shareholders. Usually, it is the most junior debt in the company's debt portfolio, and since this loan belongs to shareholders it should be treated as equity. Maturity of shareholder loans is long with low or deferred interest payments. Sometimes, shareholder loan is confused with a loan from company to shareholders.

A liability is defined as an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future.

Accounts payable is a file or account that contains money that a person or company owes to suppliers, but has not paid yet (a form of debt). When you receive an invoice you add it to the file, and then you remove it when you pay. Thus, the A/P is a form of credit that suppliers offer to their purchasers by allowing them to pay for a product or service after it has already been received.

Equity, in finance and accounting, is the residual claim or interest of the most junior class of investors in an asset, after all liabilities are paid. If valuations placed on assets do not exceed liabilities, negative equity exists. In an accounting context, Shareholders' equity (or stockholders' equity, shareholders' funds, shareholders' capital or similar terms) represents the remaining interest in assets of a company, spread among individual shareholders of common or preferred stock.

RETINC (Retained Income / (Accumulated Loss)) – is a pseudonym given for the calculation of the monthly profit or loss. The total each month is derived by summing the income statement accounts for that period. This total is then used in the balance sheet, under the Equity section, to bring through the current year profit or loss and to enable the balance sheet to balance.